Finding the right tenant is crucial for any landlord. Effective tenant screening can save you from costly evictions, property damage, and late rent payments. This article will provide essential tenant screening tips every landlord should know, covering everything from credit checks and background checks to rental applications and interviews. Learn how to thoroughly vet potential tenants and protect your investment by implementing these proven tenant screening practices.

Whether you’re a seasoned landlord or just starting out, understanding the tenant screening process is paramount to success. From verifying income and employment history to checking references and understanding legal compliance, this guide will offer invaluable insights into effective tenant screening. Discover how to select reliable, long-term tenants and avoid the pitfalls of inadequate screening. By following these tenant screening tips, you can significantly reduce risks and ensure a positive rental experience.

Importance of Thorough Screening

Thorough tenant screening is crucial for protecting your investment and ensuring a positive rental experience. A comprehensive screening process helps minimize the risks associated with renting your property, such as late rent payments, property damage, and evictions.

By carefully vetting potential tenants, you increase the likelihood of finding responsible individuals who will pay rent on time, respect the property, and abide by the terms of the lease agreement. This ultimately saves you time, money, and stress in the long run.

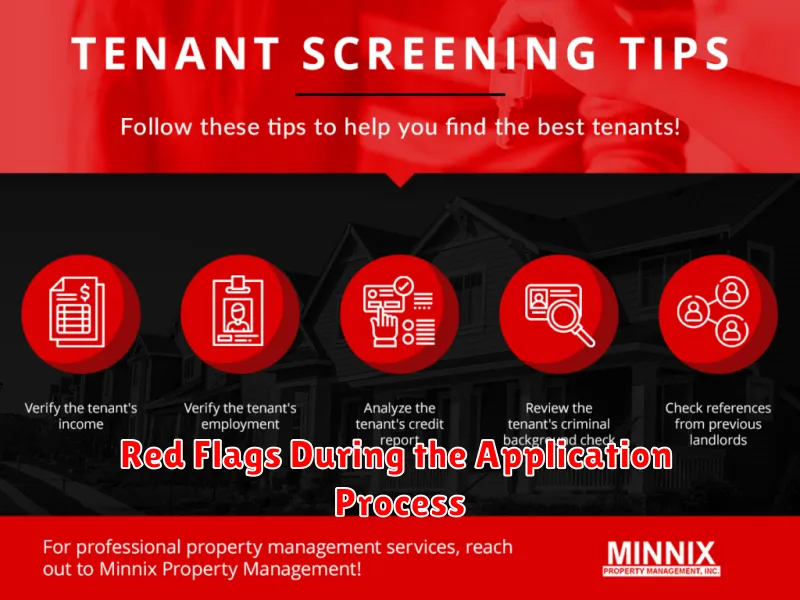

Effective screening involves verifying applicant information, including income, employment history, credit reports, and rental references. This allows you to make informed decisions and choose the best tenant for your property.

Checking Credit and Financial Stability

A crucial step in tenant screening involves assessing their financial stability. This helps determine their ability to pay rent consistently. Credit reports provide valuable insights into a prospective tenant’s financial history.

Reviewing a credit report allows you to identify potential red flags such as late payments, defaults, and high debt levels. Credit scores offer a summarized view of creditworthiness, while the report itself offers a more detailed narrative of their financial behavior.

In addition to credit reports, consider requesting proof of income, such as pay stubs or bank statements. This helps verify their current employment and income stability, further ensuring they can meet their rent obligations.

Conducting Reference Checks

Reference checks are a crucial step in the tenant screening process. They allow you to verify the information provided by the applicant and gain valuable insights into their character and rental history.

Previous Landlord Checks: Contacting previous landlords is essential. Inquire about the applicant’s payment history, adherence to lease terms, and overall behavior as a tenant. Were they respectful of the property? Did they cause any damage? Did they pay rent on time?

Employment and Income Verification: Verify the applicant’s employment and income to ensure they can afford the rent. Request pay stubs or contact their employer directly.

Personal References: While personal references can offer a different perspective on the applicant, keep in mind they may be biased. Focus on questions related to character and responsibility.

Red Flags During the Application Process

Careful tenant screening is crucial. Be wary of applicants who exhibit certain red flags during the application process. These can indicate potential problems down the road.

Application Inconsistencies

Look for inconsistencies between the application and supporting documents. Discrepancies in employment history, income, or previous addresses should raise a red flag. Verify all information provided.

Rushed Applications

Applicants who pressure you for a quick decision or avoid providing complete information may be trying to hide something. A thorough screening process is essential.

Poor Communication

Lack of responsiveness or difficulty contacting the applicant can signal future communication problems. Clear and open communication is key to a successful landlord-tenant relationship.

Legal Guidelines for Screening Tenants

Adhering to fair housing laws is crucial when screening tenants. Federal law prohibits discrimination based on race, color, national origin, religion, sex, familial status, or disability.

Additionally, many states and localities have added protected classes, such as sexual orientation and gender identity. Be aware of the specific laws in your jurisdiction.

Consistent application of your screening criteria to all applicants is essential for legal compliance. Documenting your screening process meticulously helps protect you against claims of discrimination.

Using Professional Screening Services

Employing a professional tenant screening service can significantly streamline the process and mitigate risks. These services typically handle background checks, credit reports, and eviction history, providing a comprehensive overview of potential tenants.

Key benefits of using a professional service include:

- Time savings: Services handle the entire process, freeing up your time.

- Compliance: Services ensure adherence to Fair Housing Act regulations.

- Standardized reports: Provides consistent and easy-to-interpret information.

- Reduced risk: Thorough screening helps identify potentially problematic tenants.

While there are costs associated, the long-term benefits of choosing a qualified tenant often outweigh the initial investment.

Fair Housing Compliance

Federal Fair Housing laws are crucial when screening tenants. Discrimination against protected classes is strictly prohibited. These classes include race, color, national origin, religion, sex, familial status, and disability.

Treat all applicants equally. Use the same screening criteria for everyone, such as credit checks, background checks, and income verification. Do not make exceptions or alter your requirements based on an applicant’s protected class.

Consistent application of your criteria creates a defensible process and helps ensure compliance with Fair Housing laws. Documenting your screening process thoroughly provides a valuable record in case of disputes.